The U.S. convertible bond market has long been overlooked by asset allocators and investment managers, primarily due to its small size and complexity. For managers with the requisite expertise, however, we believe convertibles are an excellent source of alpha, as the drivers of return are materially different than the non-convertible universe. Over the life of the Osterweis Strategic Income Fund, we have deployed these securities in a variety of ways to generate incremental returns that most other investors have ignored.

Small Market, Complex Product

Compared to the broader fixed income market, the convertibles market is quite small. The ICE BAML U.S. Convertible Index, which captures all outstanding domestic convertible bonds that don’t require conversion, is only $165 billion, down from over $300 billion in 2008, and the opportunity set for fixed income investors is even smaller because a portion of the outstanding convertibles trade so deeply “in-the-money” that they are essentially equity positions. As a practical matter, we estimate that the market value of investible issues that have either debt characteristics or more balanced debt/equity traits is only about $100 billion, making it too small for most fixed income managers to focus on. In addition, many convertible issues tend to be small, so large investors can’t buy enough to make a difference. The ICE BAML Liquid Convertible Index (comprising the largest issues) is only $25.7 billion today.

Another reason convertibles tend to be overlooked is that they are more complicated than their non-convertible brethren, and many investors lack the expertise required to analyze them. Identifying attractive convertible opportunities requires one to understand not only the fundamentals of the issuer and the performance characteristics of each security, but also how the various players in the market use them in portfolios. For example, some bonds are issued by excellent companies but provide little or no upside to the strong underlying fundamentals of the business. Conversely, some convertibles are highly equity sensitive but are issued by companies with questionable fundamentals and carry too much downside risk. Even veteran fixed income investors can have a difficult time understanding the performance characteristics of convertibles if they lack direct experience trading in the market.

This complexity is exactly what creates the opportunity for us, as we have the experience and knowledge necessary to identify attractive issues. Moreover, the small size of the market is not a limiting factor, as we use convertibles as a complementary asset class in our portfolio. Our convertible exposure has generally been under 10% in recent years, though it varies depending on market conditions. We believe our selective approach provides us with a distinct competitive advantage over dedicated convertible managers, who may be compelled to invest in unattractive securities just to round out their portfolio as their mandate is typically more equity centric. We have the luxury of purchasing only the bonds that align with our objectives.

Types of Convertible Bonds

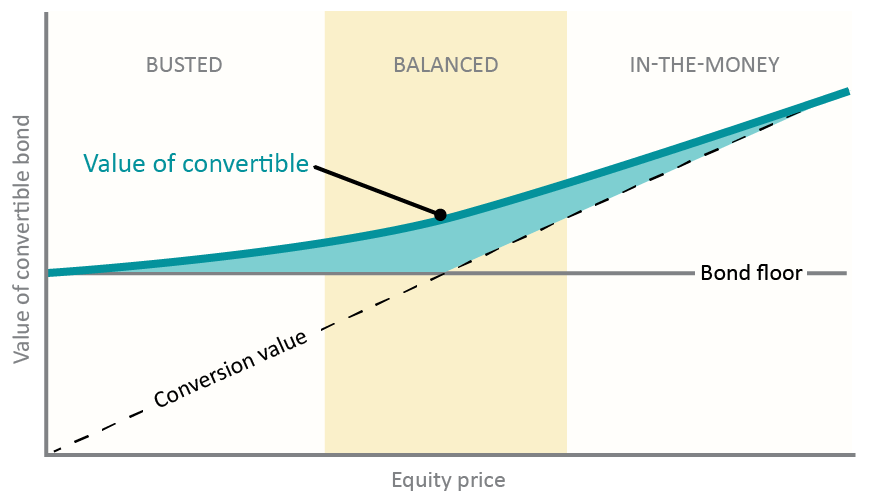

Broadly speaking, there are three types of convertible bonds: (1) bond-like or “busted” convertibles; (2) balanced convertibles; and (3) “in-the-money” or equity-like convertibles.

Source: Osterweis Capital Management

Each class is distinguished by its sensitivity to movements in the underlying stock, and the same security will change categories as its equity price fluctuates. There are no discrete rules or characteristics to define each class. Rather, each bond travels along a continuum during its lifetime.

Busted Convertibles

Busted convertibles have the least equity sensitivity of the three types, and they effectively behave like straight bonds. We are active participants in the busted convertible market, and we have been since the Fund’s inception. Although the opportunity set in the busted convertible space is neither large nor diverse enough to construct a standalone portfolio, busted names often have provided us with very attractive yields that supplement our typical core fixed income investments. This is especially true as the issues age and approach maturity. We often find bonds approaching maturity that yield well above comparable short bonds, where the underlying stocks have not performed well.

One of the main reasons we consistently find good value in busted convertibles is that the market has been structurally favorable for opportunistic buyers like ourselves. The majority of convertible debt is held by convertible arbitrage investors (“arbs”), who are long the convertible and short the equity, trying to exploit pricing inefficiencies between the two markets. Once a convertible bond is “busted” (i.e., the underlying equity price falls materially below the conversion price), it becomes more debt-like and the arbs will look for opportunities to cover their short positions and sell the convertibles. Historically, that has created excellent buying opportunities, as the arbs are motivated to sell and lock in the gain on their short equity position.

Because we are well-known within the dealer community, we are likely to receive a call when a busted bond becomes available. The issuers of convertibles are public companies, so normally when we are offered a busted opportunity there is a large body of publicly available information that we can leverage for our credit research.

Balanced Convertibles

As the name suggests, balanced convertibles have both fixed income and equity characteristics – their value rises and falls based on changes to the underlying stock price, but their debt-like structure creates an implicit floor in the value of the security. When we find a company we really like, we consider buying a balanced convertible, usually via the new issue market. A typical new issue is able to capture 50-60% of the upside move in the underlying common stock while exposing investors to only 25-35% of the stock’s downside risk.

The asymmetric payoff profile has enabled us to add some equity risk in our highest-conviction ideas without adding much volatility or downside exposure. Some of our top performing investments in the portfolio have originated as balanced convertibles. While we are extremely picky about the names we choose in this part of the market, we review every new balanced convertible that comes to market to determine whether it’s a fit for our portfolio.

Even if we don’t buy a particular issue during the initial offer, once it is trading in the open market, it goes on our watch list and may eventually become part of our portfolio. We welcome a larger opportunity set in this space as we expect it will create at least a few additional alpha-generating investments for us.

In-the-Money Convertibles

In-the-money convertibles basically behave like equity instruments. The majority of their value is derived from changes in price to the underlying stock. Our exposure to in-the-money convertibles exists only as the result of successful investments in balanced convertibles. As our price targets are reached, we tend to systematically sell down the positions to reduce our equity exposure. In rare circumstances, we might hold onto the convertible until the company redeems the bond at par and we are essentially “forced” to convert our bonds into the underlying equity or sell the position to a dealer who does the same. On rare occasions we have chosen to hold the equity, but we generally exit these types of positions to realize our gains; this is a “high class” problem we are only too happy to have!

Final Thoughts

Convertible bonds have been a very useful asset class for the Osterweis Strategic Income Fund. In our view our flexible investment mandate coupled with our extensive experience working with the asset class enables us to take advantage of opportunities that other managers either choose to ignore or are unable to access. Regardless, we believe they are a material advantage for our fund and have contributed to our performance over the years.

Craig Manchuck

Vice President & Portfolio Manager – Strategic Income

Strategic Income Fund Quarter-End Performance (as of 12/31/25)

| Fund | 1 MO | QTD | YTD | 1 YR | 3 YR | 5 YR | 10 YR | 15 YR | 20 YR |

INCEP (8/30/2002) |

|---|---|---|---|---|---|---|---|---|---|---|

| OSTIX | 0.50% | 0.73% | 5.47% | 5.47% | 8.56% | 4.89% | 5.47% | 4.93% | 5.72% | 6.17% |

| Bloomberg U.S. Aggregate Bond Index | -0.15% | 1.10% | 7.30% | 7.30% | 4.66% | -0.36% | 2.01% | 2.42% | 3.25% | 3.39% |

Gross expense ratio as of 3/31/25: 0.83%

30 Day SEC Yield as of 12/31/25: 4.83%

Performance data quoted represent past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by calling shareholder services toll free at (866) 236-0050.

Rates of return for periods greater than one year are annualized.

Where applicable, charts illustrating the performance of a hypothetical $10,000 investment made at a Fund’s inception assume the reinvestment of dividends and capital gains, but do not reflect the effect of any applicable sales charge or redemption fees. Such charts do not imply any future performance.

The Bloomberg U.S. Aggregate Bond Index (Agg) is widely regarded as the standard for measuring U.S. investment grade bond market performance. This index does not incur expenses and is not available for investment. The index includes reinvestment of dividends and/or interest income.

Source for any Bloomberg index is Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg owns all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

References to specific companies, market sectors, or investment themes herein do not constitute recommendations to buy or sell any particular securities.

There can be no assurance that any specific security, strategy, or product referenced directly or indirectly in this commentary will be profitable in the future or suitable for your financial circumstances. Due to various factors, including changes to market conditions and/or applicable laws, this content may no longer reflect our current advice or opinion. You should not assume any discussion or information contained herein serves as the receipt of, or as a substitute for, personalized investment advice from Osterweis Capital Management.

Complete holdings of all Osterweis mutual funds (“Funds”) are generally available ten business days following quarter end. Holdings and sector allocations may change at any time due to ongoing portfolio management. Fund holdings as of the most recent quarter end are available here: Strategic Income Fund

Opinions expressed are those of the author, are subject to change at any time, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. The Osterweis Strategic Income Fund may invest in debt securities that are un-rated or rated below investment grade. Lower-rated securities may present an increased possibility of default, price volatility or illiquidity compared to higher-rated securities. The Fund may invest in foreign and emerging market securities, which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks may increase for emerging markets. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Small- and mid-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Higher turnover rates may result in increased transaction costs, which could impact performance. From time to time, the Fund may have concentrated positions in one or more sectors subjecting the Fund to sector emphasis risk. The Fund may invest in municipal securities which are subject to the risk of default.

The Osterweis Funds are available by prospectus only. The Funds’ investment objectives, risks, charges, and expenses must be considered carefully before investing. The summary and statutory prospectuses contain this and other important information about the Funds. You may obtain a summary or statutory prospectus by calling toll free at (866) 236-0050, or by visiting www.osterweis.com/statpro. Please read the prospectus carefully before investing to ensure the Fund is appropriate for your goals and risk tolerance.

Convertible bond is a type of bond that the holder can convert into a specified number of shares of common stock in the issuing company or cash of equal value.

“In the money” refers to a convertible bond whose corresponding stock price is above the conversion price.

Bond floor is the lowest value to which the bond can drop.

Alpha is a measure of performance on a risk-adjusted basis. Alpha takes the volatility (price risk) of an investment and compares its risk-adjusted performance to a benchmark. The excess return of the investment relative to the return of the benchmark is an investment’s alpha.

Osterweis Capital Management is the adviser to the Osterweis Funds, which are distributed by Quasar Distributors, LLC. [39925]