A Differentiated Approach to Small Cap Growth

Gross/Net expense ratio as of 3/31/2023: 1.25%/1.13%. The Adviser has contractually agreed to waive certain fees through June 30, 2024. The net expense ratio is applicable to investors.

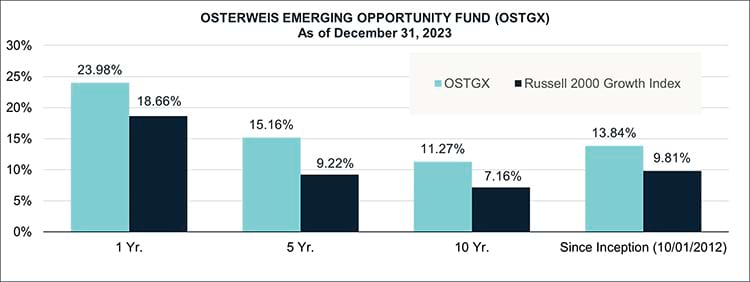

Performance data quoted represent past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by calling shareholder services toll free at (866) 236-0050. See additional disclosures at the end of the piece.

We Credit Our Success to a Focus on Key Areas

Looking for Opportunities in an Emerging Landscape

Smaller companies tend to operate in rapidly evolving markets creating opportunities for investors. Oftentimes, these emerging companies have discovered some form of fundamental change/innovation within their industries that enables them to improve their product offerings, thereby giving rise to new market leadership. Our focus on identifying quality companies, early in their lifecycles, with growing competitive advantages and revenue, gives us the opportunity to invest before they are widely discovered and appreciated by market investors. Small cap is particularly well-suited for finding undiscovered companies due to limited analyst coverage.

Leveraging Deep Industry Experience

Investing in rapidly evolving markets requires specialized, dedicated expertise. As such, our team is solely focused on our small cap growth strategy. Each team member is an analyst at heart with deep vertical expertise in their respective industry covering the major areas of the small cap growth markets (Technology, Health Care, Industrials, Consumer Discretionary, Consumer Staples, and Financials). Additionally, our San Francisco location provides us with insight and access into key trends (especially in technology and health care), which contribute to idea generation.

Not Overpaying for Growth

Valuations matter for every investment. For new positions, we are looking for a minimum of 100% upside based on an industry appropriate P/E multiple that does not exceed 30x our projected five-year earnings estimate. This focuses our investments on fast-growing companies that we believe are potentially breaking new barriers in their respective industries and plays an important role in managing portfolio risk.

Furthermore, we will not own an exceptional company at an infinite price and believe it is important to take money off the table as valuations rise. We tend to limit positions to 5% or less and automatically flag holdings for review when the absolute upside on our companies falls to 50%, which generally triggers trimming positions. This can produce higher turnover, but it is a good discipline and consequence of risk management.

Investing Only in Your Best Ideas

We believe overdiversification results in index-like performance. As active managers, we aspire to say “no” to hundreds of good investment ideas, so we can focus on the great ones that we know like the backs of our hands. With a limited number of 30-40 portfolio holdings, each investment team member can develop and maintain deeper knowledge of their respective companies to better understand the key drivers of change at each company.

A Proven Approach

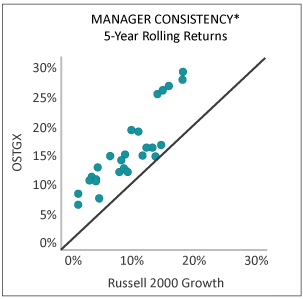

Our consistent approach has delivered outperformance over time as you can see in the following chart that shows the fund outperformed the Russell 2000 Growth Index in every 5-year rolling period since the fund’s inception (based on quarterly data):

Based on data through 12/31/2023. Performance data quoted represent past performance; past performance does not guarantee future results. The data in the table above reflect the rolling periods since inception of the fund. See disclosures for additional information.

Source: eVestment

Conclusion

We strongly believe these key differentiators set us up for continued success. At the same time, our business is incredibly demanding and requires consistent hard work and discipline. The dynamic nature of our small cap universe provides a constant flow of new secular growth opportunities. Our team strives to balance the experience and innovative thinking critical to sustain long-term success. We continue to be driven by the challenge of generating superior returns for investors.

Performance data quoted represent past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by calling shareholder services toll free at (866) 236-0050. Performance prior to December 1, 2016 is that of another investment vehicle (the “Predecessor Fund”) before the commencement of the Fund’s operations. The Predecessor Fund was converted into the Fund on November 30, 2016. The Predecessor Fund’s performance shown includes the deduction of the Predecessor Fund’s actual operating expenses. In addition, the Predecessor Fund’s performance shown has been recalculated using the management fee that applies to the Fund, which has the effect of reducing the Predecessor Fund’s performance. The Predecessor Fund was not a registered mutual fund and so was not subject to the same operating expenses or investment and tax restrictions as the Fund. If it had been, the Predecessor Fund’s performance may have been lower.

The Russell 2000 Growth Index (Russell 2000G) is a market-capitalization-weighted index representing the small cap growth segment of U.S. equities. This index does not incur expenses and is not available for investment. This index includes reinvestment of dividends and/or interest.

References to specific companies, market sectors, or investment themes herein do not constitute recommendations to buy or sell any particular securities.

Manager Consistency Chart: The dots represent 5-year annualized returns for the Osterweis Emerging Opportunity Fund and corresponding returns of the Russell 2000 Growth Index as of quarter-end dates since the inception of the fund (excluding the initial periods before a 5-year record was established). The line represents the hypothetical plot if the fund never out/underperformed the Index and all Fund returns were exactly equal to the Index returns.

Price-to-Earnings (P/E) Ratio is the ratio of a company’s stock price to its 12 months’ earnings per share.

There can be no assurance that any specific security, strategy, or product referenced directly or indirectly in this commentary will be profitable in the future or suitable for your financial circumstances. Due to various factors, including changes to market conditions and/or applicable laws, this content may no longer reflect our current advice or opinion. You should not assume any discussion or information contained herein serves as the receipt of, or as a substitute for, personalized investment advice from Osterweis Capital Management.

Opinions expressed are those of the author, are subject to change at any time, are not guaranteed and should not be considered investment advice.

The Osterweis Opportunity Fund may invest in unseasoned companies, which involve additional risks such as abrupt or erratic price movements. The Fund may invest in small and mid-sized companies, which may involve greater volatility than large-sized companies. The Fund may invest in IPOs and unseasoned companies that are in the early stages of their development and may pose more risk compared to more established companies. The Fund may invest in ETFs, which involve risks that do not apply to conventional funds. Higher turnover rates may result in increased transaction costs, which could impact performance. From time to time, the Fund may have concentrated positions in one or more sectors subjecting the Fund to sector emphasis risk. The Fund may invest in foreign and emerging market securities, which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks may increase for emerging markets.

The Osterweis Funds are available by prospectus only. The Funds’ investment objectives, risks, charges and expenses must be considered carefully before investing. The summary and statutory prospectuses contain this and other important information about the Funds. You may obtain a summary or statutory prospectus by calling toll free at (866) 236-0050, or by visiting www.osterweis.com/statpro. Please read the prospectus carefully before investing to ensure the Fund is appropriate for your goals and risk tolerance.

Osterweis Capital Management is the adviser to the Osterweis Funds, which are distributed by Quasar Distributors, LLC. [OCMI-484114-2024-01-18]