Steepening the (Adoption) Curve: Covid-19 and Digital Transformation

Published on July 8, 2020

In the era of social distancing, technology has become even more integrated into our personal and professional lives. We believe this trend will persist even after the pandemic passes, and we expect it will particularly benefit firms that support remote working arrangements and eCommerce, two areas where we anticipate accelerating adoption and sustained growth.

Despite the massive decline in economic activity caused by the coronavirus, technology stocks have rallied since hitting their low in March. At first glance this strong performance may seem unwarranted, but we believe the growth makes perfect sense. As we have written previously, the economy was already in the midst of a digital transformation before Covid-19, and social distancing has significantly accelerated the process.

The pandemic has also broadened the scope of the transformation. Not only have industry leaders like Amazon, Facebook, and Netflix prospered as people have opted for the safety of home delivery and virtual interactions, but smaller, disruptive tech firms that support the expanding digital ecosystem have also grown substantially. In addition, social distancing has introduced challenges that not even Silicon Valley could have predicted, and it has created a need for solutions that did not exist before the pandemic.

Technology Has Moved Into the Mainstream

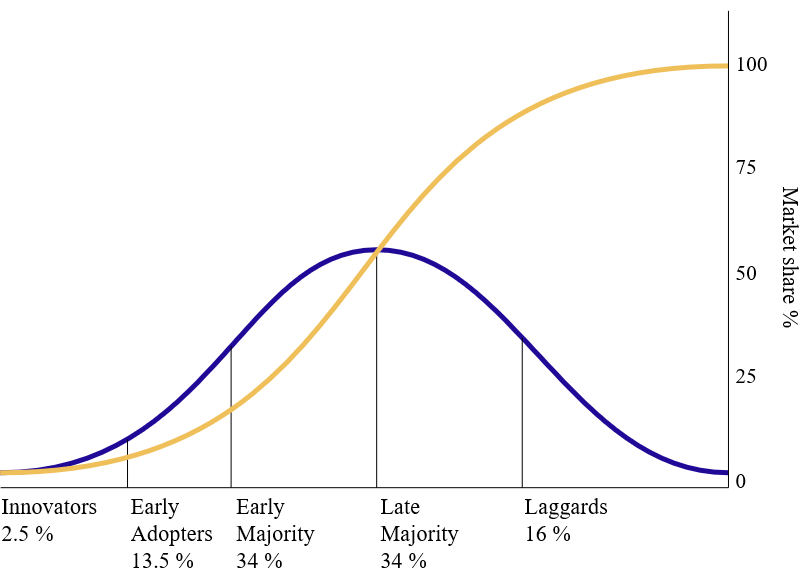

We believe the pandemic has fundamentally changed society’s attitude about technology, and we expect the shift will be lasting and durable. In our view, Everett Rogers' “Diffusion of Innovations” theory provides a useful framework to understand what is happening. According to Rogers, society can be divided into five basic categories that define an individual’s (or organization’s) likelihood to adopt new technology: innovators, early adopters, early majority, late majority, and laggards.

Source: Rogers, E. (1962) Diffusion of innovations. Free Press, London, NY, USA

The theory states that adoption tends to move through these cohorts sequentially, like a domino effect. Each group analyzes the experience of the previous group to decide whether to become adopters themselves. If the feedback is positive, the cycle progresses, and the cumulative adoption rate continues to climb (as shown by the yellow line in the above diagram.)

In our view, the pandemic radically accelerated this process, as both consumers and businesses had little choice but to embrace technological solutions. In first quarter earnings calls, CEOs from across the industry consistently spoke about accelerating customer adoption, confirming that the dominoes were falling much faster than expected. Satya Nadella, Microsoft’s CEO, said, “We’ve seen two years’ worth of digital transformation in two months.” Likewise, JPMorgan recently surveyed 130 CIOs about the effect of Covid-19, and 79% of respondents agreed that it will act as a forcing function to make them digitally transform faster than they had planned.

As the pandemic passes, adoption rates may normalize, but we believe that the post-pandemic level of market penetration will be substantially higher than pre-pandemic levels. Niche technologies that would otherwise have been the province of “innovators” and “early adopters” have been propelled into the “early majority” and “late majority” categories well ahead of schedule, and established technologies have been able to reach the laggards.

According to Diffusion Theory, once a technology penetrates the “early majority” cohort, a tipping point is reached and adoption rates increase rapidly. In our view, the events of the past few months have pushed a wide range of technologies into this group, and these are the firms we believe will be the best investment opportunities going forward.

Two Key Growth Areas: Remote Work and eCommerce

Two particular areas within technology that we expect to experience substantial growth are remote working arrangements and eCommerce. The pandemic has allowed both employers and employees to appreciate the benefits of a distributed workforce, and we anticipate that some form of telecommuting will become the new normal. Similarly, eCommerce, which was already quite popular, will continue to grow as a result of the pandemic, as both consumers and businesses have become accustomed to the convenience and efficiency of online shopping.

We have always believed the best investment opportunities arise when an industry experiences a disruptive transformation, and we believe this is such a moment for firms that support remote work and eCommerce.

Work from Anywhere

Prior to the coronavirus, remote working arrangements were almost uniformly the exception rather than the rule. Attitudes and policies varied by company, but most organizations preferred staff members to be on site.

Covid-19 upended the status quo almost overnight. A recent survey of 1,500 hiring managers from Upwork, an online platform that connects employers and freelancers, provides some concrete data around the change. According to the report, “the share of remote workers in the U.S. has quadrupled to nearly 50% of the nation’s workforce” since social distancing began.

Perhaps more importantly, the survey also revealed that:

- 56% of hiring managers feel that the shift to remote work has gone better than expected, while only one in ten feel it has gone worse than expected.

- The expected growth rate of full-time remote work over the next five years has doubled, from 30% to 65%.

- The single biggest drawback is technological issues, a problem that is likely a result of the rapid and unplanned shift and one that would be mitigated over time.

A separate survey by Buffer, a software company that develops social media tools, analyzed employee attitudes about telecommuting. They asked nearly 2,500 remote workers about their experience, and 99% said they would like to work remotely at least some of the time for the rest of their careers.

In other words, both employers and employees agree that remote work is here to stay. In fact, several large technology firms have already come forward to say that their employees can work remotely indefinitely. Twitter is leading the way, with CEO Jack Dorsey declaring, “If our employees are in a role and situation that enables them to work from home and they want to continue to do so forever, we will make that happen.” Facebook has taken a similar long-term view. In a recent interview, CEO Mark Zuckerberg said, “Over the next five to ten years, I think we could get to about half of the company working remotely permanently.”

All of this suggests that the infrastructure required to support remote work will continue to be in high demand for the foreseeable future. In the meantime, companies in this space have seen revenues surge and multiples expand, which is giving some investors pause – particularly those who are skeptical about the long-term viability of telecommuting. We do not share these concerns. On the contrary, we believe that the higher valuations make sense given that the technology to support remote work has become indispensable.

Below we explore two firms from our portfolio that we expect to benefit from the growth in telecommuting.

Bandwidth Inc.(BAND)

Bandwidth is a software firm that sells cloud-based communications technology, also known as a communications platform as a service (CPaaS). The company develops white-labeled components (e.g., voice, messaging, 911 access) that other firms can integrate into their proprietary communications systems and rebrand as their own. For example, Zoom, the online video conferencing platform, uses Bandwidth’s voice technology to support its audio infrastructure.

Naturally, the explosive growth of Zoom has been a material tailwind for Bandwidth. In December of 2019, Zoom had 10 million daily meeting participants. As of late April, the company was hosting 300 million daily participants. Beyond its relationship with Zoom, Bandwidth also powers communications for large technology firms like Microsoft and Google. We believe the company is extremely well-positioned to benefit from a longer-term shift to remote working and increased video conferencing, as the company develops essential building blocks for digital communication.

As an aside, Bandwidth and Zoom are both great examples of how the pandemic has not only accelerated technology adoption, but also been a catalyst for innovation. Zoom was originally developed as an enterprise application for businesses to communicate with other businesses, but thanks to Covid-19 it has evolved into an essential tool for schools, church groups, and social events. That shift also benefits Bandwidth.

Five9 Inc. (FIVN)

Five9 sells cloud-based contact center software that allows service reps to interact with customers through a variety of communications channels. They have developed a comprehensive end-to-end solution that scales to meet the needs of any organization and can be easily deployed across a remote workforce. Before Covid-19 the company was already growing market share by displacing legacy, on-premise systems in a $24 billion market which was only 10-15% penetrated by cloud software.

Since social distancing started, the company has seen demand surge, as the Five9 platform easily enables service reps to work remotely. Furthermore, Five9’s software provides customers with extensive monitoring and reporting capabilities, which reduces the importance of employees sitting in the same physical location as management. Many organizations will likely take advantage of the opportunity to reduce office space to save costs, as agents can work effectively from home. Recent partnerships with both Zoom and AT&T are a strong validation of Five9’s capabilities and growth opportunity.

Expanded eCommerce

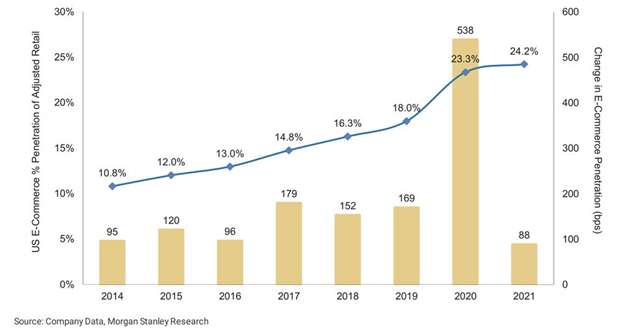

eCommerce was an integral part of the economy long before the pandemic started, and it was growing at a healthy pace. Nonetheless, the pandemic was a transformative event. In a recent report, Morgan Stanley estimated that ~2 years of eCommerce adoption was pulled forward in 2020. This is part of a longer-term trend as eCommerce penetration has more than doubled from ~10% in 2014 to 23% in 2020.

During the peak of the sheltering-in-place experience, with over 300 million Americans stuck at home, eCommerce became the country’s primary purchasing method. Not only did the proportion of online shopping increase as a percentage of total retail activity, but services that were previously rendered in person became virtualized. The biggest shift was in the delivery of health care – demand for telemedicine surged as both physicians and patients tried to limit in person visits to help contain the spread of the virus. Education also moved online for students at all levels, as schools closed around the country. Professional services also went digital, as scores of newly unemployed white-collar workers turned to online marketplaces to find work.

We believe that many of these behavioral changes will remain in place for years to come. For example, online grocery shopping doubled from 20 million U.S. customers in February (pre-Covid) to 40 million in April. Now that both the grocery providers and customers have become comfortable with the process, there is little doubt that many will continue to order their groceries online. Another survey by JPMorgan confirms an upward inflection in online grocery not just for non-perishable goods, but perishable goods as well, “indicating consumers’ prior preference for buying fresh in-store has deteriorated.” JP Morgan recently raised its long-term U.S. eCommerce penetration forecast to 35-40%.

Below we look at two firms from our portfolio that we expect to benefit from the increased appetite for eCommerce.

Teladoc Health, Inc. (TDOC)

Teladoc is a global virtual health care provider. The company offers a comprehensive suite of virtual medical services, and not surprisingly patient demand grew rapidly as a result of Covid-19. During the first quarter of 2020, year-over-year visits increased 92% to over 2 million. Revenues grew 41% to $180 million over the same period. Going forward, the company estimates that visits for the full year in 2020 will be between 8-9 million, and they are expecting full year revenues of $800-$825 million.

Prior to the pandemic, telemedicine was mostly an afterthought – most people were either unaware it existed or simply preferred going to the doctor in person. But now that so many patients have experienced it first-hand, we believe adoption will continue to accelerate as virtual visits are far more convenient than physical visits, particularly for simple conditions. Moreover, as a larger share of the workforce is working from home, it will be easier for patients to have private conversations – which could be challenging in an office setting.

Chegg, Inc. (CHGG)

Chegg is an education technology company that provides digital and physical textbook rentals, online tutoring, and other student services. Demand for online educational resources spiked during the pandemic, as most schools and colleges suspended in-person instruction. Chegg’s subscriber business grew 35% in the most recent quarter, as did its top line revenue.

CEO Dan Rosenweig believes that Covid-19 has pulled forward the shift to online learning, possibly by several years, as there is an even greater need for high-quality, low-cost online education. With many students and educators facing uncertainty about the upcoming academic year, Chegg finds itself in conversations with entire state school systems about how it can provide more support. Even as schools re-open, we expect online education will continue to play a strong role in supplementing (and in some cases, replacing) traditional brick and mortar education.

Looking Ahead

In this piece we have focused on two areas of the economy that we believe will create lasting opportunities for investors, but we are confident additional secular growth trends will emerge. Global pandemics are extremely rare (fortunately), but one silver lining is that they are the type of event that can inspire a wave of innovation that leads to a new generation of disruptive technologies.

James Callinan, CFA

Chief Investment Officer – Emerging Growth

Bryan Wong, CFA

Vice President & Portfolio Manager - Emerging Growth

Emerging Opportunity Fund Quarter-End Performance (as of 3/31/24)

| Fund | 1 MO | QTD | YTD | 1 YR | 3 YR | 5 YR | 7 YR | 10 YR |

INCEP (10/1/2012) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| OSTGX | 4.46% | 12.10% | 12.10% | 26.31% | -0.87% | 13.72% | 15.68% | 12.93% | 14.65% | |

| Russell 2000 Growth Index | 2.80 | 7.58 | 7.58 | 20.35 | -2.68 | 7.38 | 8.40 | 7.89 | 10.29 | |

Gross/Net expense ratio as of 3/31/23:1.25% / 1.13%. The Adviser has contractually agreed to waive certain fees through June 30, 2024. The net expense ratio is applicable to investors.

Performance data quoted represent past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by calling shareholder services toll free at (866) 236-0050. Performance prior to December 1, 2016 is that of another investment vehicle (the “Predecessor Fund”) before the commencement of the Fund’s operations. The Predecessor Fund was converted into the Fund on November 30, 2016. The Predecessor Fund’s performance shown includes the deduction of the Predecessor Fund’s actual operating expenses. In addition, the Predecessor Fund’s performance shown has been recalculated using the management fee that applies to the Fund, which has the effect of reducing the Predecessor Fund’s performance. The Predecessor Fund was not a registered mutual fund and so was not subject to the same operating expenses or investment and tax restrictions as the Fund. If it had been, the Predecessor Fund’s performance may have been lower.

Rates of return for periods greater than one year are annualized.

Where applicable, charts illustrating the performance of a hypothetical $10,000 investment made at a Fund’s inception assume the reinvestment of dividends and capital gains, but do not reflect the effect of any applicable sales charge or redemption fees. Such charts do not imply any future performance.

The Russell 2000 Growth Index (Russell 2000G) is a market-capitalization-weighted index representing the small cap growth segment of U.S. equities. This index does not incur expenses, is not available for investment and includes the reinvestment of dividends.

References to specific companies, market sectors, or investment themes herein do not constitute recommendations to buy or sell any particular securities.

There can be no assurance that any specific security, strategy, or product referenced directly or indirectly in this commentary will be profitable in the future or suitable for your financial circumstances. Due to various factors, including changes to market conditions and/or applicable laws, this content may no longer reflect our current advice or opinion. You should not assume any discussion or information contained herein serves as the receipt of, or as a substitute for, personalized investment advice from Osterweis Capital Management.

Complete holdings of all Osterweis mutual funds (“Funds”) are generally available ten business days following quarter end. Holdings and sector allocations may change at any time due to ongoing portfolio management. Fund holdings as of the most recent quarter end are available here: Emerging Opportunity Fund

Opinions expressed are those of the author, are subject to change at any time, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. The Osterweis Emerging Opportunity Fund may invest in unseasoned companies, which involve additional risks such as abrupt or erratic price movements. The Fund may invest in small and mid-sized companies, which may involve greater volatility than large-sized companies. The Fund may invest in IPOs and unseasoned companies that are in the early stages of their development and may pose more risk compared to more established companies. The Fund may invest in ETFs, which involve risks that do not apply to conventional funds. Higher turnover rates may result in increased transaction costs, which could impact performance. From time to time, the Fund may have concentrated positions in one or more sectors subjecting the Fund to sector emphasis risk. The Fund may invest in foreign and emerging market securities, which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks may increase for emerging markets.

Holdings and allocations may change at any time due to ongoing portfolio management. References to specific investments should not be construed as a recommendation to buy or sell the securities. Current and future holdings are subject to risk.

The Osterweis Emerging Opportunity Fund’s top 10 holdings may be viewed by clicking here.

The Osterweis Funds are available by prospectus only. The Funds’ investment objectives, risks, charges and expenses must be considered carefully before investing. The summary and statutory prospectuses contain this and other important information about the Funds. You may obtain a summary or statutory prospectus by calling toll free at (866) 236-0050, or by visiting www.osterweis.com/statpro. Please read the prospectus carefully before investing to ensure the Fund is appropriate for your goals and risk tolerance.

Osterweis Capital Management is the adviser to the Osterweis Funds, which are distributed by Quasar Distributors, LLC. [45989]