What, Me Worry?

The second quarter began with the Trump administration’s announcement of a new tariff regime on “Liberation Day” and ended with the United States joining Israel in bombing Iran. Along the way, the reconciliation bill began working its way through Congress and the ongoing conflicts in Ukraine and Gaza produced their own share of concerning headlines. Despite all this, the markets remained curiously calm. Alfred E. Neuman would be proud…

After an initial drawdown of 12% on the S&P 500 following Liberation Day, the markets fully recovered, ending the quarter at an all-time high, up nearly 11% for the period. It is becoming clear that each subsequent headline has less and less impact on investor sentiment. We are loath to wade into politics, but we are reminded of a saying that describes our President well: supporters take him seriously but not literally and his detractors take him literally but not seriously. It feels like the market has decided to stay out of politics and fall somewhere between his supporters and detractors.

After an initial series of smaller trade-related executive orders, Trump unveiled his massive Liberation Day package on April 2nd, imposing a 10% baseline tariff on imports from virtually every country and higher tariffs on countries with whom the U.S. maintained larger trade deficits. This led to a global selloff in risk assets as investors feared the tariffs would be inflationary, triggering flashbacks of supply chain disruptions during the pandemic. On April 9th, the administration reversed course by announcing a 90-day pause on the implementation of the tariffs, which led to a market rally and a new acronym: TACO (Trump Always Chickens Out). Putting cheeky market phrases aside, the tariff conversation is tremendously complicated and retains the ability to cause significant disruptions to the economy. For now, however, the market seems optimistic that cooler heads will prevail.

Unfortunately, geopolitical conflict increased significantly during the quarter. While Israel has continued its siege of Gaza and of Hezbollah in Lebanon, they also expanded their efforts into Iran. On June 21st, the United States joined Israel in its attack of Iran by bombing three alleged nuclear development sites. At the same time, the conflict between Russia and Ukraine continues and shows little sign of reaching a peaceful conclusion.

Lastly, the development that should most concern the bond market is the administration’s “Big Beautiful” Reconciliation Bill, which the independent Congressional Budget Office (CBO) estimates will increase the federal deficit by $2.4 trillion over the 2025-2034 period. This will come on top of the already ~$36 trillion of federal debt outstanding. Given that many nations have curbed their buying of U.S. Treasuries, the question of how this increased deficit will be financed remains unanswered. Stablecoins, a cryptocurrency backed by Treasuries, will create some but not all of the missing demand and regulators are contemplating loosening bank capital restrictions to allow them more leeway to buy Treasuries. We fear there may be some unintended consequences if that change occurs.

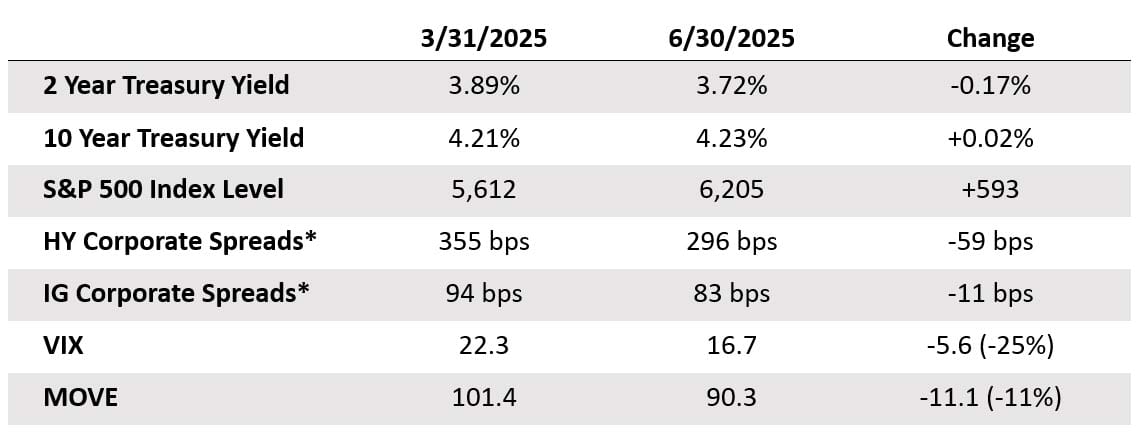

So how did the markets respond over the quarter? With a gap-toothed shrug of its shoulders. Pretty much every risk metric in the market improved during the quarter, and perhaps most tellingly the measures of volatility in the equity market (VIX) and the bond market (MOVE) both ended the quarter lower:

*HY reflects the ICE BofA U.S. High Yield Index and IG reflects the Bloomberg U.S. Corporate Index.

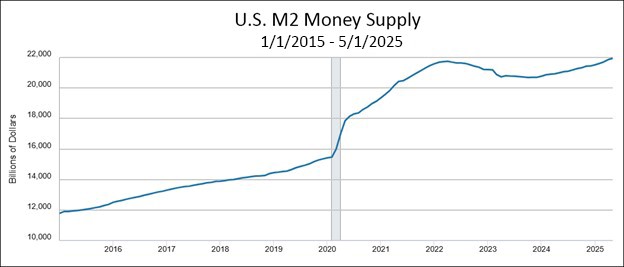

While the explanations for muted markets are numerous and an exercise in speculation, we see two potential drivers. First, the financial markets continue to be awash in liquidity. As we have discussed previously, money supply as measured by M2 stands at an all-time high. It jumped 4.5% year-over-year in May, marking its 19th consecutive monthly increase. It has now surpassed the previous all-time high of $21.86 trillion, posted in March 2022. Since 2020, the M2 money supply has risen nearly $7 trillion, or ~45%. One definition of inflation is more money chasing fewer goods. There is certainly more money chasing financial assets today.

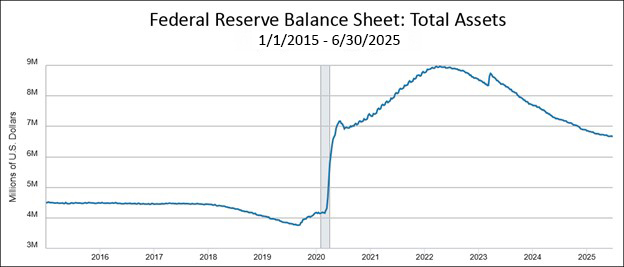

Another source of liquidity for financial assets is the Federal Reserve balance sheet. While the Fed’s efforts have reduced the balance sheet through the roll-off of Treasury and mortgage-backed securities, its balance sheet remains significantly elevated compared to pre-pandemic levels.

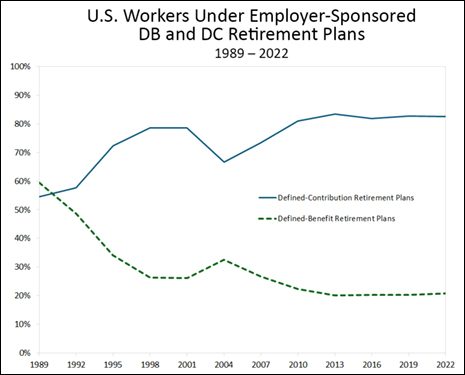

We have also been focused on the impact of passive investing as a potential cause of dampened volatility in markets. One source of growth in passive investing is the Pension Protection Act of 2006, which prompted a shift in retirement assets from defined benefit plans to defined contribution plans. Defined benefit plans encourage active management as corporations are incentivized to generate the best returns possible to limit their future liability (and capital contributions) to fund predetermined benefits to their retirees. Defined contribution plans, primarily 401(k)s, on the other hand, have led to many individuals picking a basket of passive funds and “setting and forgetting.” This is also true for non-retirement investing, as a plethora of very low-cost investment options are now available. Passive investment dollars now exceed actively managed mutual funds and ETFs. Aside from the aforementioned “set it and forget it” strategy, an actively managed mutual fund typically needs to sell the individual fund holdings when they experience large outflows. A passively managed ETF can be liquidated to another buyer of the ETF without the underlying holdings ever being touched. This has led to less volume and ultimately less volatility around the trading of the assets in funds.

Moving to high yield, the biggest sector in our portfolio, the ICE BofA U.S. High Yield Index experienced a strong second quarter return of 3.6%. On a yield basis, the index has stayed in a range of 7.1% to 8.7% during the period, which investors find attractive for an asset with a duration at or below about 3.35.

To further illustrate the point, we look to the new issue market. The year began with a moderate pace of $69 billion issuance in the first quarter. Not surprisingly, this virtually dried up in April around the Liberation Day volatility. Fortunately, as the saying goes, April showers bring May flowers, and May ended up being the most active month this year as the fears subsided. We took advantage and participated in several attractively priced new issues in the quarter. The coupons of the bonds we bought were almost 3% more on average than the coupons of bonds that we currently own. This recycling to higher coupons is a key underpinning of demand for high yield.

Additionally, as we discuss in our recent white paper, the credit quality of high yield has improved significantly in the past few years, as many weaker borrowers exited this space and now seek financing in the leveraged loan and private credit markets.

Going forward, we will remain selective in deploying new capital. The excess liquidity in the market is masking many of the risk factors covered in this piece. We do not know when, but we know there will be another disruption in the market that could open up attractive entry points for us to utilize our ample liquidity. In the meantime, we will continue looking for opportunities to invest in companies that meet our criteria and provide acceptable risk/reward metrics for our investors.

Thank you for your continued confidence in our management.

Carl Kaufman

Co-President, Co-Chief Executive Officer, Chief Investment Officer – Strategic Income & Managing Director – Fixed Income

Bradley Kane

Vice President & Portfolio Manager – Strategic Income

Craig Manchuck

Vice President & Portfolio Manager – Strategic Income

John Sheehan, CFA

Vice President & Portfolio Manager – Strategic Income

The Osterweis Funds are available by prospectus only. The Funds’ investment objectives, risks, charges, and expenses must be considered carefully before investing. The summary and statutory prospectuses contain this and other important information about the Funds. You may obtain a summary or statutory prospectus by calling toll free at (866) 236-0050, or by visiting www.osterweis.com/statpro. Please read the prospectus carefully before investing to ensure the Fund is appropriate for your goals and risk tolerance.

Mutual fund investing involves risk. Principal loss is possible.

The Osterweis Strategic Income Fund may invest in debt securities that are un-rated or rated below investment grade. Lower-rated securities may present an increased possibility of default, price volatility or illiquidity compared to higher-rated securities. The Fund may invest in foreign and emerging market securities, which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks may increase for emerging markets. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Small- and mid-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Higher turnover rates may result in increased transaction costs, which could impact performance. From time to time, the Fund may have concentrated positions in one or more sectors subjecting the Fund to sector emphasis risk. The Fund may invest in municipal securities which are subject to the risk of default.

Past performance does not guarantee future results.

This commentary contains the current opinions of the authors as of the date above, which are subject to change at any time, are not guaranteed, and should not be considered investment advice. This commentary has been distributed for informational purposes only and is not a recommendation or offer of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

No part of this article may be reproduced in any form, or referred to in any other publication, without the express written permission of Osterweis Capital Management.

Current and future holdings are subject to risk.

Investment grade/non-investment grade (high yield) categories and credit ratings breakdowns are based on ratings from credit ratings agencies such as Standard and Poor’s, which is a private independent rating service that assigns grades to bonds to represent their credit quality. The issues are evaluated based on such factors as the bond issuer’s financial strength and its ability to pay a bond’s principal and interest in a timely fashion. Standard and Poor’s ratings are expressed as letters ranging from ‘AAA’, which is the highest grade, to ‘D’, which is the lowest grade. A rating of BBB- or higher is considered investment grade and a rating below BBB- is considered non-investment grade. Other credit ratings agencies include Moody’s and Fitch, each of whom may have different ratings systems and methodologies.

Performance data quoted represent past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by calling shareholder services toll free at (866) 236-0050.

Investment and insurance products are not FDIC or any other government agency insured, are not bank guaranteed, and may lose value.

A basis point is a unit that is equal to 1/100th of 1%.

Treasuries are securities sold by the federal government to consumers and investors to fund its operations. They are all backed by “the full faith and credit of the United States government” and thus are considered free of default risk.

Yield is the income return on an investment, such as the interest or dividends received from holding a particular security. A yield curve is a graph that plots bond yields vs. maturities, at a set point in time, assuming the bonds have equal credit quality. In the U.S., the yield curve generally refers to that of Treasuries.

The S&P 500 Index is widely regarded as the standard for measuring large cap U.S. stock market performance. The index does not incur expenses, is not available for investment, and includes the reinvestment of dividends.

The Bloomberg U.S. Aggregate Bond Index (Agg) is widely regarded as the standard for measuring U.S. investment grade bond market performance. This index does not incur expenses and is not available for investment. The index includes reinvestment of dividends and/or interest income.

The Bloomberg U.S. Corporate Index includes publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. To qualify, bonds must be SEC-registered. The index includes exclusively corporate sectors, including Industrial, Utility, and Finance, which include both U.S. and non-U.S. corporations.

Source for any Bloomberg index is Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg owns all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The ICE BofA U.S. High Yield Index tracks the performance of U.S. dollar denominated below-investment grade corporate debt publicly issued in the U.S. domestic market.

Effective 6/30/22, the ICE indices reflect transactions costs. Any ICE index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its Third Party Suppliers and has been licensed for use by Osterweis Capital Management. ICE Data and its Third Party Suppliers accept no liability in connection with its use. See https://www.osterweis.com/glossary for a full copy of the Disclaimer.

{indices_expenses}

Coupon is the interest rate paid by a bond. The coupon is typically paid semiannually.

Duration measures the sensitivity of a fixed income security’s price to changes in interest rates. Fixed income securities with longer durations generally have more volatile prices than those of comparable quality with shorter durations.

A mortgage-backed security (MBS) is a type of asset-backed security that is secured by a mortgage or collection of mortgages.

The Chicago Board Options Exchange (CBOE) Volatility Index, or VIX, is a real-time market index that represents the market’s expectation of 30-day forward-looking volatility.

The ICE BofA MOVE Index measures U.S. bond market volatility by tracking a basket of OTC options on U.S. interest rate swaps. The Index tracks implied normal yield volatility of a yield curve weighted basket of at-the-money one month options on the 2-year, 5-year, 10-year, and 30-year constant maturity interest rate swaps.

M2 is the U.S. Federal Reserve’s estimate of the total money supply, including all the cash people have on hand, plus all the money deposited in checking accounts, savings accounts, and other short-term saving vehicles such as certificates of deposit (CDs).

Osterweis Capital Management is the adviser to the Osterweis Funds, which are distributed by Quasar Distributors, LLC. [OCMI-766133-2025-07-08]